If you’re exploring sheet metal services in the U.S.—whether for manufacturing parts, building equipment, or partnering with a fabricator—here’s the core breakdown: The U.S. sheet metal industry is a $35+ billion sector (2024 data from the Fabricators & Manufacturers Association, FMA) that fuels industries like aerospace, construction, automotive, and HVAC. It’s defined by precision fabrication, diverse material options (from steel to aluminum), and a focus on custom solutions. To make the most of it, you need to understand the market landscape, top materials, how to choose a reliable fabricator, regulatory standards, and emerging trends. Let’s break this down clearly.

Key Overview of the U.S. Sheet Metal Market

The U.S. sheet metal industry employs over 250,000 workers across more than 12,000 facilities, making it a cornerstone of domestic manufacturing. Its largest customer is the construction industry, which accounts for 32% of demand—think ductwork for commercial buildings, roofing panels, and structural supports.

A real-world example: A Texas-based sheet metal fabricator supplied 10,000+ square feet of galvanized steel ductwork for the new Dallas/Fort Worth International Airport terminal. The fabricator used computer-aided design (CAD) to ensure the ductwork fit perfectly with the terminal’s unique architecture, cutting installation time by 20% compared to traditional methods.

Beyond construction, the aerospace sector is a critical driver (18% of market share, FMA 2024)—sheet metal is used to make aircraft fuselage parts, wing components, and engine housings, which require ultra-tight tolerances (as small as 0.005 inches). The “reshoring” trend is also boosting the market: Since 2023, 35% of U.S. manufacturers have moved sheet metal production back from overseas to avoid supply chain delays and ensure quality control (FMA survey).

Top Materials for U.S. Sheet Metal Fabrication

Choosing the right sheet metal material depends on your project’s needs—strength, weight, corrosion resistance, and cost all play a role. Below’s a breakdown of the most common materials used in U.S. sheet metal work, with their benefits and real-world applications:

| Material | Key Advantages | Common Applications | U.S. Market Share |

| Carbon Steel | High strength, low cost, easy to weld | Structural supports, automotive frames, tool boxes | 40% (FMA 2024) |

| Aluminum | Lightweight (1/3 the weight of steel), corrosion-resistant | HVAC ductwork, aircraft parts, beverage cans | 25% |

| Stainless Steel | Corrosion-resistant, durable, easy to clean | Medical equipment, food processing machines, sinks | 18% |

| Copper | Excellent electrical conductivity, malleable | Electrical wiring, roofing, decorative elements | 7% |

Example of material selection: A Minnesota-based medical fabricator uses 304 stainless steel to make surgical tables. Stainless steel’s corrosion resistance ensures the tables can be sterilized repeatedly, while its strength supports heavy equipment. For aerospace, Boeing relies on 6061 aluminum for aircraft wing parts—aluminum’s light weight reduces fuel costs, and its strength meets strict safety standards.

How to Choose a Reliable Sheet Metal Fabricator in the U.S.

Picking the right fabricator can mean the difference between a successful project and costly delays. Here’s a step-by-step guide to find a partner that fits your needs:

- Verify Industry Certifications: Look for fabricators with certifications that match your sector. For aerospace parts, AS9100 is non-negotiable—it ensures compliance with NASA and FAA standards for precision and safety. A California fabricator that supplies SpaceX holds AS9100 and undergoes quarterly audits to maintain its status. For food-grade projects, ISO 22000 is critical—this standard ensures sheet metal parts (like conveyor belts) are safe for food contact.

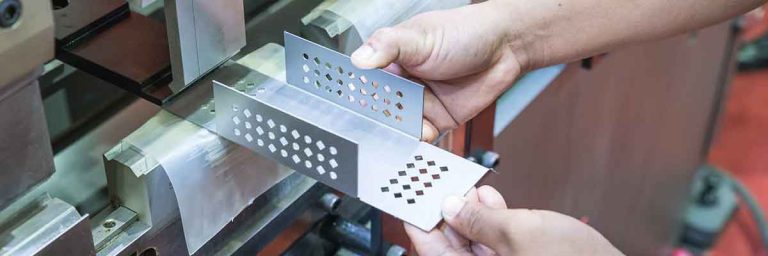

- Evaluate Fabrication Capabilities: Ask about the equipment and processes they offer. If you need complex, custom parts (like curved aircraft components), look for fabricators with CNC laser cutting (for precision) and press braking (for bending metal into shapes). A Michigan fabricator, for example, uses a 6kW CNC laser cutter to cut steel sheets up to 1 inch thick with 0.001-inch accuracy—ideal for automotive frame parts. For high-volume projects (like HVAC ductwork), ensure the fabricator has automated assembly lines to speed up production.

- Review Quality Control (QC) Processes: Top fabricators have in-house QC teams and tools like coordinate measuring machines (CMMs) to check part dimensions. A Ohio fabricator that makes structural steel for skyscrapers uses CMMs to test 100% of its parts—ensuring they meet building codes and can support heavy loads. They also keep detailed QC records for 5 years, as required by construction regulators.

- Assess Sustainability Practices: With growing demand for eco-friendly manufacturing, choose a fabricator that recycles scrap metal and uses energy-efficient equipment. The U.S. sheet metal industry recycles 85% of its scrap (FMA data), but some fabricators go further. A Oregon fabricator uses solar power to run its laser cutters and recycles 95% of its aluminum scrap, cutting carbon emissions by 30% compared to traditional facilities.

U.S. Sheet Metal Regulations and Compliance

Compliance is essential in U.S. sheet metal work—rules protect workers, ensure product safety, and reduce environmental impact. Here are the key regulations to know:

- Environmental Regulations: The EPA’s Clean Air Act limits emissions of metal dust and fumes from fabrication processes (like welding and cutting). Fabricators must use dust collectors and air filtration systems to meet these standards. A New York fabricator was fined $30,000 in 2023 for failing to control welding fumes, violating the Clean Air Act. The EPA also regulates scrap metal disposal—fabricators must recycle or dispose of scrap at certified facilities to avoid soil contamination.

- Worker Safety Standards: OSHA mandates strict safety rules for sheet metal workers, including wearing protective gear (safety glasses, steel-toe boots) and using lockout-tagout (LOTO) procedures to prevent machine accidents. A Illinois fabricator was cited in 2024 for not training workers on LOTO, leading to a $15,000 fine.

- Industry-Specific Standards: For construction, the American Institute of Steel Construction (AISC) sets standards for sheet metal structural parts—ensuring they can withstand earthquakes, wind, and other hazards. For aerospace, the FAA requires sheet metal parts to pass rigorous stress tests (like pressure and temperature resistance) before they’re used in aircraft.

Trends Shaping the Future of U.S. Sheet Metal

The U.S. sheet metal industry is evolving quickly—staying ahead of these trends will help you stay competitive:

- Automation and Robotics: More fabricators are using robots for repetitive tasks like welding and material handling. A Pennsylvania fabricator installed robotic welding arms that work 24/7, increasing production speed by 40% and reducing human error. Some fabricators are also using AI-powered software to optimize cutting patterns—minimizing scrap metal waste by up to 15%.

- Lightweight Materials for EVs: As electric vehicle (EV) sales grow (projected to reach 50% of U.S. new car sales by 2030, per the U.S. Department of Energy), sheet metal fabricators are shifting to lightweight materials like aluminum and high-strength steel. A Michigan fabricator supplies Tesla with aluminum sheet metal for EV bodies—aluminum’s light weight helps extend battery range, while its strength meets crash safety standards.

- Customization for Niche Markets: With the rise of small-batch manufacturing (e.g., custom medical devices, specialty aerospace parts), fabricators are offering more flexible, custom solutions. A Colorado fabricator uses 3D scanning to create custom sheet metal enclosures for startup tech companies—turning design ideas into finished parts in as little as 3 days.

Yigu Technology’s Perspective on U.S. Sheet Metal

As a global provider of manufacturing solutions, Yigu Technology sees the U.S. sheet metal industry as a hub of innovation and reliability. The sector’s focus on precision (critical for aerospace and medical) and sustainability aligns with our mission to deliver efficient, eco-friendly tools. We’ve noticed U.S. fabricators increasingly need flexible solutions—like AI-powered design software and automated equipment—to meet growing demand for custom parts. Yigu’s sheet metal processing machines, such as high-speed CNC laser cutters and energy-efficient press brakes, are tailored to these needs, helping fabricators boost productivity while reducing waste. We believe the U.S. sheet metal industry will remain a key driver of domestic manufacturing, and we’re proud to support its growth.

FAQ About Sheet Metal in the United States

1. How much does sheet metal fabrication cost in the U.S.?

Costs vary by material, part complexity, and volume. For small, simple parts (like aluminum brackets), costs start at $5–$15 per unit. For large, complex parts (like aerospace components), costs can be $100–$500 per unit. Labor and equipment (e.g., CNC laser cutting) add 20–30% to the total cost. U.S. fabricators often offer discounts for high-volume orders (1,000+ units).

2. What’s the typical lead time for a sheet metal project in the U.S.?

Lead times depend on project size: Small, custom parts (1–100 units) take 1–2 weeks. Medium-volume projects (100–1,000 units) take 2–4 weeks. Large-volume or complex projects (1,000+ units, e.g., HVAC ductwork) take 4–8 weeks. Many fabricators offer rush services (for an extra 10–20% cost) to cut lead times by 30%.

3. Can U.S. sheet metal fabricators handle both small-batch and high-volume projects?

Yes. Most U.S. fabricators are flexible: They use manual or small-scale CNC machines for small-batch (prototyping) work and automated lines for high-volume production. For example, a Washington fabricator makes 10 custom sheet metal enclosures for a startup (small-batch) and 10,000 aluminum brackets for an auto manufacturer (high-volume) using the same facility.

4. Are there regional hotspots for sheet metal fabrication in the U.S.?

Absolutely. The top regions are:

- Midwest: Michigan, Ohio, and Illinois (focus on automotive and construction, close to Detroit’s auto plants and Chicago’s construction hubs).

- West Coast: California and Washington (aerospace and tech, serving SpaceX, Boeing, and Silicon Valley startups).

- Southeast: Texas and Florida (HVAC and commercial construction, driven by population growth).