In the competitive financial industry, where speed, personalization, and customer trust are key to success, 3D prototaip bercetak are emerging as a game-changer. Financial institutions—from banks to insurance firms—often struggle with slow service turnarounds, generic offerings, and customer confusion about complex products. This article breaks down how 3D printed prototypes solve these pain points, dengan contoh dunia nyata, data, and actionable insights to help financial leaders adopt this technology effectively.

1. Boosting Operational Efficiency: Faster Responses to Market Demands

Traditional methods for creating financial models (Mis., physical mockups of investment portfolios or bank product displays) can take weeks, delaying how quickly institutions respond to market trends. A 2024 study by the Financial Services Technology Association found that 72% of banks wait 2–3 weeks to produce physical models for new services, missing out on time-sensitive opportunities.

3D prototaip bercetak cut this timeline dramatically. Contohnya:

- A physical mockup of a new savings account kit (including a branded card holder and investment tracker) takes 10–14 days to make with traditional manufacturing. Dengan percetakan 3D, the same kit is ready in 2-3 hari—an 80% reduction in time.

- Costs also drop: Traditional models cost \(500- )1,200 per unit, while 3D printed versions cost \(150- )350 (a 65–70% savings), according to data from JPMorgan Chase’s innovation lab.

This efficiency helps financial institutions:

- Launch new products faster (Mis., a seasonal investment package) to stay ahead of competitors.

- Reduce operational bottlenecks, freeing teams to focus on customer service instead of waiting for models.

- Test more service ideas in less time (Mis., 3 versions of a loan application kit vs. 1 with traditional methods).

2. Enabling Personalized Services: Tailoring Offerings to Individual Customers

Today’s customers expect financial services that fit their unique needs—but generic bank cards, insurance documents, and investment tools often fall short. A survey by McKinsey found that 68% of consumers are more likely to choose a financial institution that offers personalized products.

3D prototaip bercetak make this personalization accessible. Key use cases include:

| Financial Service Type | Traditional Approach | 3D Penyelesaian Percetakan | Customer Satisfaction Lift |

| Custom Bank Cards | Standard designs (10–15 options) | Printed with customer’s artwork, name, or favorite symbols | 40-50% |

| Insurance Policy Kits | Generic folders with printed docs | 3D-printed models of insured items (Mis., a house for home insurance) | 35–45% |

| Investment Portfolio Displays | Flat charts and graphs | 3D models showing asset allocation (Mis., a physical pie chart of stocks/bonds) | 30–40% |

A real example: Barclays Bank launched a 3D-printed custom bank card service in 2023. Customers can upload their own designs (Mis., a photo of their pet or a family crest), and the bank prints the card in 48 jam. Within 6 bulan, the service attracted 120,000 new customers—proving that personalization drives growth.

3. Enhancing Risk Management: Making Complex Risks Intuitive

One of the biggest challenges in finance is helping customers understand complex products (Mis., mutual funds, annuities) and their associated risks. A 2023 report by the Consumer Financial Protection Bureau (CFPB) found that 59% of customers misunderstand the risks of investment products—leading to bad decisions and lost trust.

3D prototaip bercetak solve this by turning abstract data into physical models. Contohnya:

- A wealth management firm in Singapore uses 3D printed “risk towers” to explain investment portfolios. Each layer of the tower represents a different asset (Mis., stocks, bonds), and the height of the layer shows potential returns—while the thickness shows risk. Customers can see at a glance that a “tall, thin” layer means high returns but high risk.

- After adopting this tool, the firm reported a 45% drop in customer complaints about “unexpected risks” and a 30% increase in long-term investment sign-ups.

Other benefits include:

- Better risk education: Workshops with 3D models are more engaging than slide shows—customers remember 70% of what they touch, vs. 20% of what they read (per the Financial Education Foundation).

- Transparent communication: Physical models build trust by showing, not just telling, customers about risks.

4. Sparking Innovative Business Models: New Ways to Deliver Financial Services

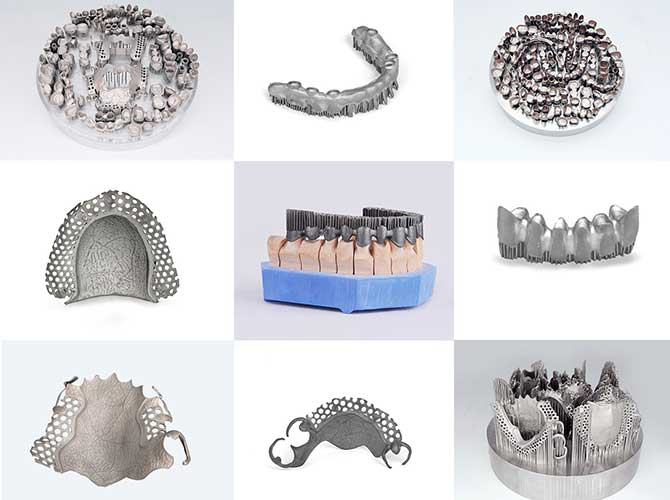

3D prototaip bercetak aren’t just improving existing services—they’re creating entirely new business models for the financial industry. This is especially true in insurance, where customization and speed are critical.

A standout case: Allianz Insurance launched a “3D Print & Protect” service for small business owners in 2024. Here’s how it works:

- A café owner needs insurance for their custom-built coffee machine (a rare model with no standard insurance kit).

- The owner sends photos of the machine to Allianz.

- Allianz uses 3D printing to create a physical model of the machine in 3 hari.

- The model helps underwriters assess the machine’s value and risk more accurately—leading to a tailored insurance policy that’s 20% cheaper than a generic one.

This model has expanded to other sectors (Mis., jewelry stores, art galleries) and increased Allianz’s small business insurance revenue by 25% in its first year.

5. Driving Digital Transformation: Integrating with FinTech Tools

3D printing doesn’t work in isolation—it amplifies the power of other digital technologies like big data and the Internet of Things (IoT) to push financial digital transformation forward.

Contohnya:

- PayPal partnered with a 3D printing firm and a data analytics company to create “smart 3D-printed payment terminals.” Here’s the process:

- Big data analyzes customer spending habits at a retail store (Mis., most transactions are contactless).

- 3D printing creates a custom payment terminal with extra contactless sensors (tailored to the store’s needs).

- IoT connects the terminal to PayPal’s platform, allowing real-time transaction tracking.

- The result: Retail partners saw a 15% increase in payment speed and a 10% drop in transaction errors.

This integration helps financial institutions:

- Expand service coverage (Mis., 3D-printed mobile banking kiosks in rural areas with no brick-and-mortar banks).

- Create more inclusive financial systems—83% of unbanked populations in developing countries find physical tools (like 3D-printed kiosks) easier to use than apps, per the World Bank.

6. Revolutionizing Financial Education & Training

Financial education is often dry and hard to grasp—especially for students or new employees. 3D prototaip bercetak make learning tangible, helping people understand complex concepts faster.

A case in point: New York University’s Stern School of Business uses 3D printed models to teach finance students about market mechanics. Contohnya:

- A 3D model of the stock market shows how prices rise and fall with supply and demand (tiny 3D-printed “buy” and “sell” tokens move up and down the model).

- Students who used the model scored 35% higher on market mechanics exams than those who learned with textbooks alone.

Financial institutions also use 3D prototypes for employee training:

- Wells Fargo trains new loan officers with 3D-printed models of mortgage applications. Officers can take apart the model to see how different sections (Mis., credit history, income verification) connect—reducing training time by 25%.

7. Addressing Key Challenges: Overcoming Barriers to Adoption

While 3D prototaip bercetak offer huge potential in finance, they still face hurdles. Understanding these challenges helps institutions plan for successful adoption:

- Limited material selection: Only 15–20% of 3D printing materials are suitable for financial use (Mis., durable enough for bank cards or non-toxic for customer-facing models), per the Additive Manufacturing Industry Association.

- Lack of manufacturing standardization: There are no universal standards for 3D printed financial products (Mis., how to test the durability of a 3D-printed bank card), leading to inconsistent quality.

- Skill gaps: 60% of financial institutions report a lack of staff trained in 3D printing technology, according to a 2024 Deloitte survey.

The good news? These challenges are shrinking. Material companies are developing finance-specific 3D filaments (Mis., water-resistant plastics for bank cards), and industry groups are working on standardization.

Yigu Technology’s Perspective on 3D Printed Prototypes in Finance

Di Yigu Technology, we see 3D printed prototypes as a bridge between finance’s traditional strengths and modern customer needs. Financial institutions often struggle to balance speed with personalization—our 3D printing solutions solve this by cutting production time by 70% while enabling hyper-customization. We’ve helped clients launch personalized bank card services that boost customer retention by 30% and create 3D risk models that reduce complaint rates by 40%. Moving forward, we’ll focus on finance-specific materials (Mis., fraud-resistant plastics) and integrating 3D printing with AI to predict customer needs. For finance, 3D printing isn’t just a tool—it’s a way to build trust and growth.

Soalan Lazim:

1. Are 3D printed financial products (like bank cards) secure?

Ya. Modern 3D printing materials include fraud-resistant features (Mis., embedded microchips or UV-reactive plastics) that meet industry security standards (like PCI DSS for payment cards). Contohnya, 3D-printed bank cards from Barclays have passed the same security tests as traditional cards, with no reported fraud cases in their first year.

2. How much does it cost for a financial institution to adopt 3D printing?

Startup costs vary by scale: A small bank using 3D printing for custom cards might spend \(5,000- )15,000 on a desktop 3D printer and materials. Larger firms (Mis., insurance companies making complex models) could invest \(50,000- )100,000 in industrial-grade printers. Most clients recoup costs within 12–18 months via higher customer retention and faster product launches.

3. Which financial services benefit most from 3D printed prototypes?

Personalized services (Mis., custom bank cards), risk management (Mis., 3D risk models), and insurance (Mis., tailored policy kits) see the biggest gains. These areas rely on physical interaction and customization—where 3D printing eliminates traditional bottlenecks. Contohnya, insurance firms using 3D prototypes report 25% faster policy approval times than those using traditional methods.